Debt Free Life

ARE YOU 100% SURE YOU’LL HAVE A GREAT RETIREMENT, OR DO YOU HAVE SOME DOUBT?

What if we could show you how to be out of debt in 9 years or less including your mortgage without spending any additional dollars than you are spending right now?

Call The Office

(479) 435-7233

Office Location

3608 N. Steele Blvd, Suite 103a

Fayetteville, AR 72703

Email Us

Debt Free Life

Our unique approach to financial education has always centered around families. We believe that financially strong homes today, lay the foundation to bright futures for tomorrow’s generation.

Unlike most financial advisors, who primarily focus on advising their clients on specific financial products they sell – 401k, IRA, Mutual Funds, & Stocks, Debt Free Life teaches a proven personal financial literacy program that is based on 7 steps that allow people to get immediate control of their spending, debt, savings, and taxation. We have a comprehensive financial management system that helps individuals and families effectively manage every aspect of their financial lives.

Concept

Many American are on a treadmill, with goals to be further ahead but just can’t seem to get their with tax, tuition, inflation, the rising cost of health care, and countless other factors. Enter the Debt Free Life concept.

A unique way to get off the treadmill. It’s rather simple actually…stop paying banks and lenders. Take every dollar and make it go to work for you. Avoid risk and secure your future with guaranteed growth you can count on.

To learn about how this concept can work for you, make sure to attend our next seminar!

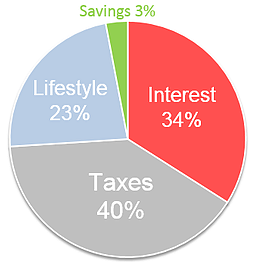

Money Percentage

The average individual pays 34% of the money they earn in a lifetime out to interest. This interest goes to cars, credit cards, student loans, mortgages, all the things we finance is interest going out…and we pay taxes! About $.40 of every dollar the average American earns goes out to taxes. Everything from income tax, to sales tax, capital gains tax, gas tax, estate tax, etc.

This leaves approximately 26% to pay for everything else like vehicles, clothes, insurance, gas, etc. We call this Lifestyle money. Of this amount, only 3% goes towards savings…

Most financial advisors concentrate on that 3% savings. You know what they say… “You’ve got to save more money” but most people are unable.

With Debt Free Life, we focus on the problem, 34% going to interest and 40% to taxes.

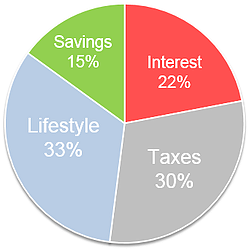

What if we could reduce that 34% going to interest and also reduce taxes? That would allow for more lifestyle money and would also free up cash to contribute towards savings!

Using the Debt Free Life 7 steps of Money Management, we can do just that.

LET’S LOOK AT HOW BANKS LEVERAGE CASH FLOW

How Banks Work

You put a $10,000 in the bank, and the bank may give you 1% interest on those funds.

Walk in the next day and try to get a $10,000 loan, what would your interest rate be? …24%, 12%, 5%, 29% it all depends on variables like credit score, what you’re getting a loan for, etc.

You make 1%. The bank makes whatever percent they choose because banks are a business!

How would you like to be the bank?

-

Use your dollar like a bank

-

Give every dollar two jobs

-

Create compounding interest for yourself

I was reviewing our bills and was frustrated that no matter how hard I tried, I couldn’t seem to lower our debt. I couldn’t figure out what I was doing wrong. After listening to (my DFL producer) and seeing the numbers on paper, I have to admit, the program intrigued me. I told them that at this point there had to be a better way then what I was doing and was willing to try anything.

Come to find out, (this) way was better. We have now been on the plan for almost two years now and have paid off over $50,000.00 in debt. I should also mention that we have not had to change our lifestyle either. Our personalized financial plan shows that we could be completely debt-free within 10 years, including our mortgage, and still be able to send our 2 children to college and retire without financial hardship.

Thank you for being patient with a skeptic and providing the tools to obtain a debt-free future.

Our Experts and Speakers

Mike Colburn

CEO and Founder of Colburn Financial

Brad Smith

Associate Partner

Christopher Clark

Chief Strategy Officer